- Home

- Sustainability

- Response to the Recommendations of TCFD

Environmental Measures

- Environmental Philosophy and Principles

- Response to the Recommendations of TCFD

- Environmental Management

- Setting Environmental Targets

- Action to Reduce the Environmental Impact

- Chemical Substances Management

- Environmentally Friendly Products

Response to the Recommendations of TCFD

Climate change is an important issue that humanity must resolve if we are to realize a sustainable society. We consider action against climate change to be a prerequisite for business continuity for any company.

Dexerials declared its support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) in September 2021 and will contribute to the realization of a sustainable society through the appropriate and timely disclosure of information about management risks and opportunities associated with climate change.

In addition, by providing new value through our own products and technologies, we will promote initiatives to leave a rich environment to future generations, with the aim of harmonious co-existence with our stakeholders.

Disclosure in accordance with the TCFD recommendations

Governance

The Company is promoting activities geared toward the achievement of a sustainable society based on the direction of the executive officer in charge of the Sustainability Promotion Division with the representative director and president as the final authority. To assist in the deployment of specific activities, the Company has, with the participation of the relevant departments, organized Sustainability Working Groups (SWGs) to promote the activities in a united, company-wide manner on the basis of our corporate philosophy, corporate vision, and Sustainability Policy. On the basis of important challenges specified by the Board of Directors, the SWGs set issues by theme and regularly set and monitor goals and activities for those issues.

They also enhance activities and promote in-company awareness by taking inter-divisional perspectives into consideration.

Reported to and discussed at meetings of the Board of Executive Officers and Board of Directors as appropriate, individual important themes concerning the promotion of sustainability, including climate change-related challenges, are fed back in the formulation and execution of management strategies.

Sustainability Promotion System

Sustainability Promotion SystemStrategy

At Dexerials, to identify the risks and opportunities associated with climate change on a long-term time axis up to 2050, we are performing analyses taking into account two (1.5–2°C and 4°C) scenarios.

In fiscal 2022, we expanded the scope of products subject to scenario analyses, assessed their impacts on business, and discussed countermeasures.

Scope of Products Subject to Scenario Analyses

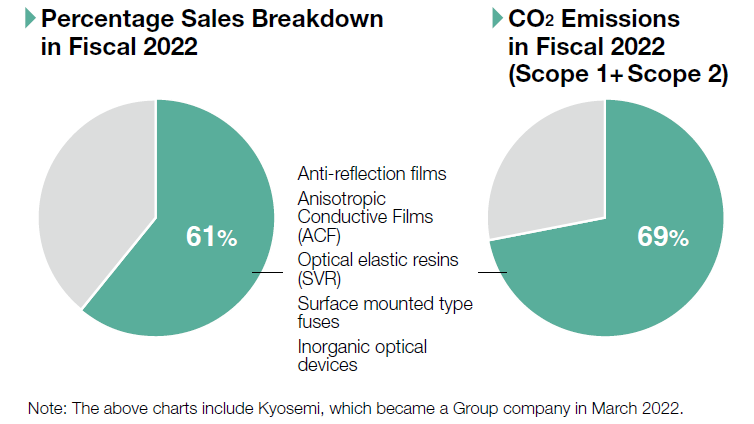

We are performing scenario analyses that prioritize those of the Company’s mainstay products that have a significant impact on our finances and on CO2 emissions.

In addition to Anti-reflection films, Anisotropic Conductive Flms (ACF), Optical elastic resins (SVR), and Surface mounted type fuses, all of which had been subjected to analysis in fiscal 2021, in fiscal 2022 we performed scenario analyses by adding Inorganic optical devices (Inorganic waveplates, Inorganic polarizers, Inorganic diffusers) manufactured by consolidated subsidiary Dexerials Photonics Solutions Corporation.

Setting of Scenarios

Having considered the impact on our Group from objective future information with regard to risk and opportunity matters, we discussed the future worldview surrounding our Group.

1.5–2°C scenario

As a result of our carbon-neutral efforts, there are accelerated movements toward the realization of a decarbonized society and a recycling-oriented society, in which the average temperature rises by less than 2°C by the end of this century compared with pre-Industrial Revolution levels.

- Reference scenarios:

IEA World Energy Outlook Sustainable Development Scenario

IEA World Energy Outlook Net Zero Emissions by 2050

IPCC AR6 WG1 SSP1-1.9

IPCC AR6 WG1 SSP1-2.6, etc.

4°C scenario

With only limited progress in carbon-neutral efforts, the average temperature 2°C or more by the end of this century compared with pre-Industrial Revolution levels.

- Reference scenarios:

IEA World Energy Outlook Stated Policies Scenario

IPCC AR6 WG1 SSP5-8.5, etc.

| World of the 1.5-2°C scenario | World of the 4°C scenario |

|---|---|

|

・Moves toward the creation of a decarbonized and recycling-based society accelerate. ・The percentage of renewable energies such as solar and wind power in the electric power mix increases drastically. ・The carbon tax rate against CO2 emissions is increased significantly. ・Because of the transition to a recycling-based society, the shift to bio and recycled materials accelerates. ・Society is more streamlined and shifts to an ultra-smart society. ・In the automobile market, the electrification of automobiles and shift to autonomous driving make progress, which changes the space in a vehicle to a living space. |

・Risks of a rise in sea level, high tide water, floods, heavy rains, etc. emerge, which affects our and our suppliers' operations and increases the costs of responding to them. ・Demands for fossil fuels increase, which increases the costs of fossil fuels. ・Along with the rise in temperature, an increase in the frequency of disasters, and spread of infectious diseases, etc., lifestyles change; e.g., Stay-home time is extended. |

Climate-related Risks/Opportunities and Main Initiatives for Them

We identified climate-related risks and opportunities for the scope of products subject to scenario analyses, extracted important risks and opportunities that could potentially have a major impact on our business, and then considered initiatives to address them.

TCFD scenario analyses

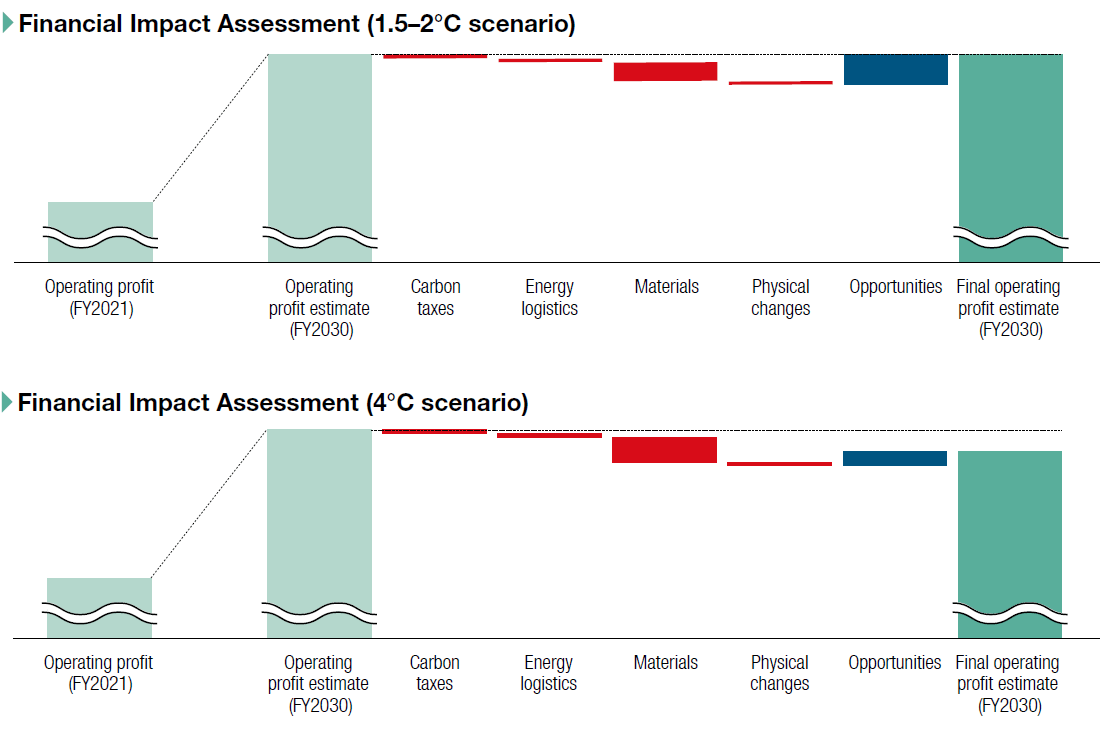

Assessment of business impact

In the 1.5–2°C scenario, more rigorous GHG emission regulations will increase costs, such as carbon pricing, energy, and raw materials. However, due to the digitalization accompanying the transition to a smart society, there will be increased sales opportunities—for Anti-reflection films, Anisotropic Conductive Films (ACF), Optical elastic resins (SVR), and Inorganic optical devices—as demand for displays increases due to the progress of the car interior digitalization caused by the shift to EVs and the growth of the AR/VR and metaverse markets. Demand for lithium-ion batteries is also expected to increase due to the expansion of the market for secondary batteries used in home appliances and power tools.

Thus sales opportunities for Surface mounted type fuses for secondary protection will also expand, and sustainable growth is expected.

In contrast, in the 4°C scenario we expect sales growth to decelerate as the continued dependence on fossil fuels, increased costs of energy and raw materials due to growing demand for fossil fuels, as well as slow progress in the transition to a smart society, will lead to a loss of sales opportunities.

Going forward, we will expand the scope of products subject to scenario analyses and assess their financial impacts.

Expected financial impacts

Risk Management

In accordance with its rules and regulations on risk management, the Group has established a Risk Management Committee, is conducting assessments of business operational risks for the entire Group, taking measures to avoid or reduce risks, and monitoring their progress.

Chaired by the executive officer in charge of risk management, the Risk Management Committee consists of subcommittees for each specialized field and holds its meetings periodically (or on an as needed basis). In the case of the challenges posed by climate change, the relevant jurisdictional subcommittees examined the primary risks, discussed them in Risk Management Committee meetings as risk candidates that needed to be addressed, and selected them as risks to be regularly reported to management.

Metrics and Targets

Dexerials has set CO2 emissions as climate-related evaluation metrics and, by utilizing renewable energy, is aiming to achieve zero CO2 emissions from consuming electricity for business by 2030.

Additionally, based on the scenario analyses, we will consider long-term change metrics and targets such as the reduction of CO2 emissions in business activities.

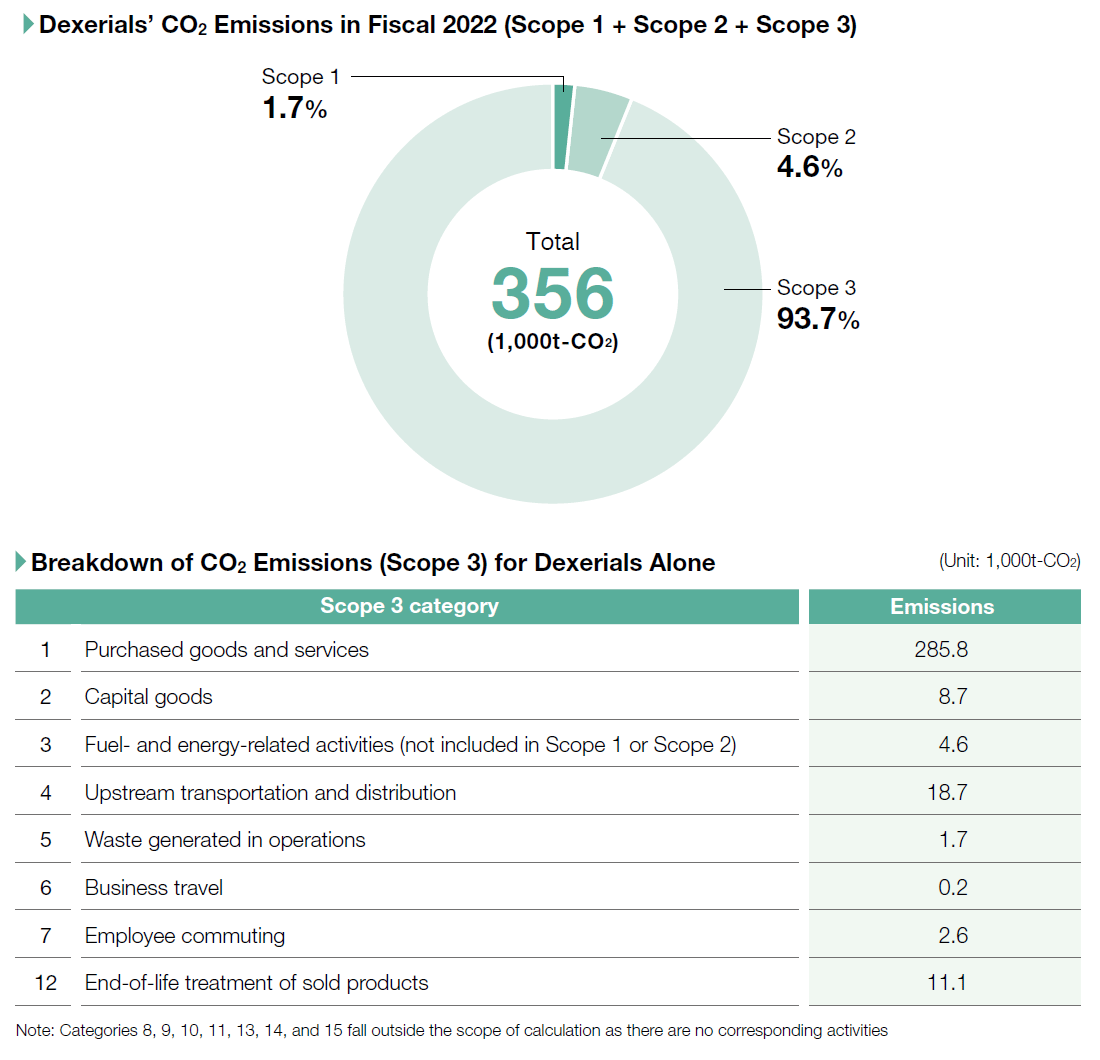

CO2 Emission

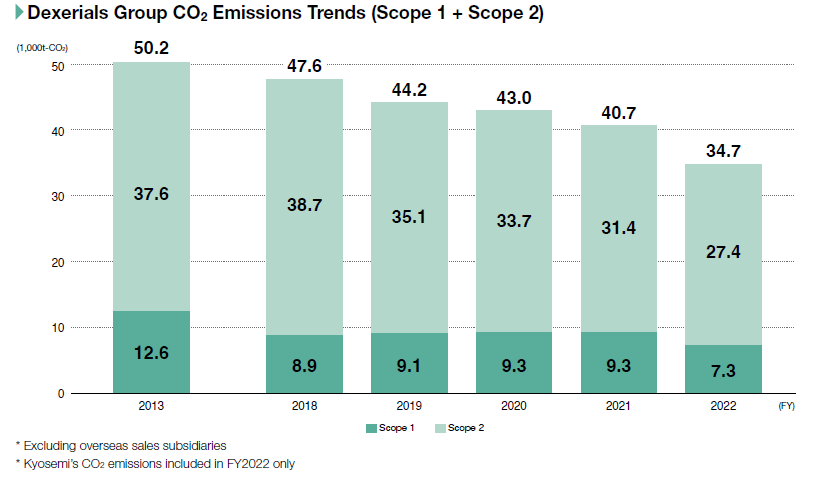

Scope 1, Scope 2

Scope 1 and Scope 2 were calculated for all offices of the Dexerials Group.

In fiscal 2022, while sales increased by 10.9% compared with fiscal 2021, CO2 emissions decreased by 14.7% compared with fiscal 2021 by promoting the introduction of renewable energy in addition to conventional energy-saving activities. This represented a decrease of approximately 31% compared with the fiscal 2013.

Scope 3

We calculated CO2 emissions (Scope 3) in the supply chain for all domestic business operations, excluding subsidiaries.

In fiscal 2022, supply chain CO2 emissions (Scope 3) amounted to 333,000t-CO2, which represents more than 90% of Dexerials’ CO2 emissions on a standalone basis.