- Home

- About Dexerials

- Corporate Governance

Corporate Governance

Basic Approach to Corporate Governance

Our company recognizes that establishing robust corporate governance is a critical management priority in achieving our purpose, balancing economic and social value, and continuously enhancing sustainable growth and corporate value. Our management team is committed to identifying strategic direction in the VUCA※ era and to maintaining and strengthening a governance framework that enables swift and decisive decision-making (including risk-taking), while continuously evolving toward more effective and transparent corporate governance.

※VUCA…Volatility、Uncertainty、Complexity、Ambiguity

Initiatives to Strengthen Corporate Governance

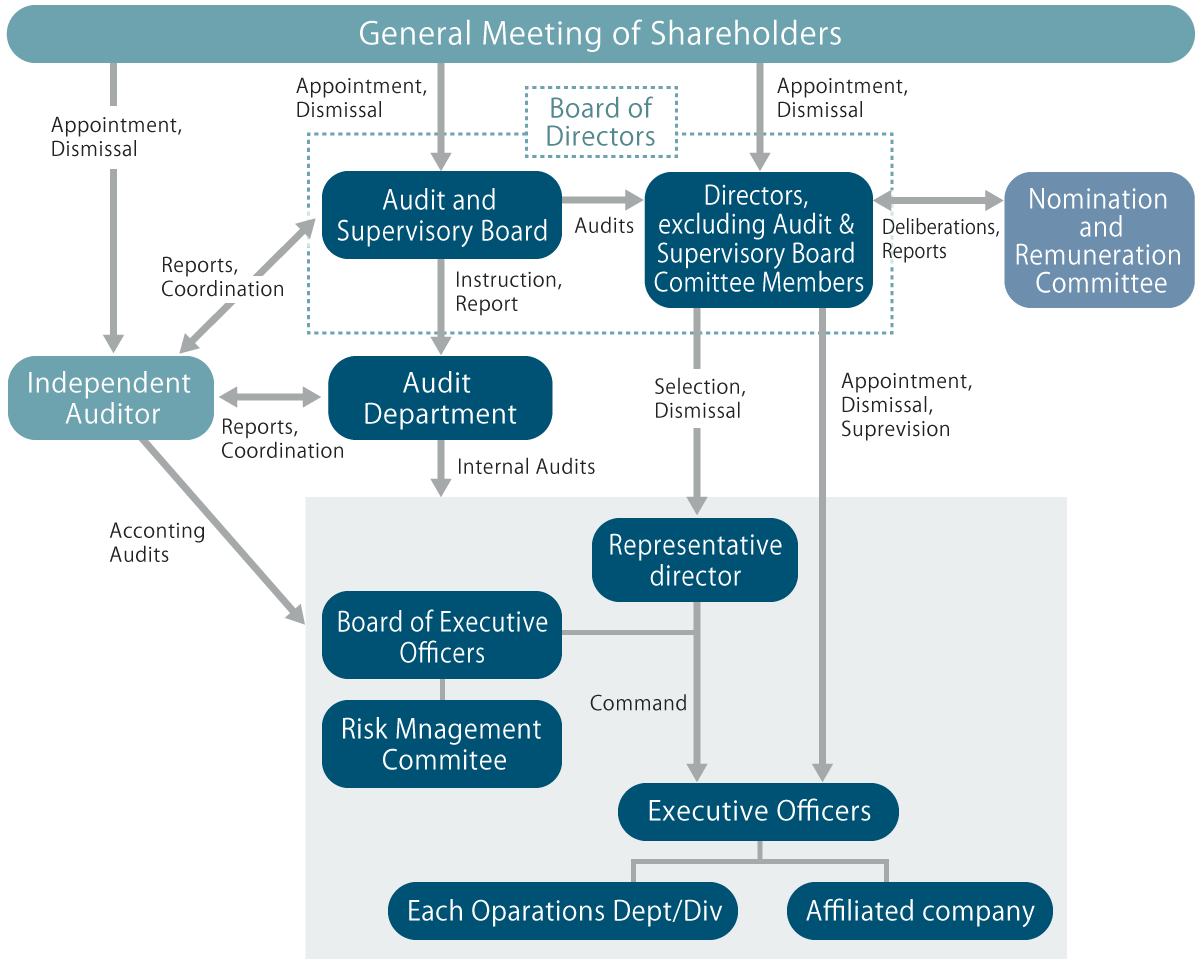

Since our listing in 2015, we have consistently maintained a governance structure in which a majority of the Board consists of independent outside directors with high levels of expertise, ensuring transparency and objectivity in management oversight. In 2019, we established a voluntary Nomination and Remuneration Committee, composed of a majority of outside directors, with an outside director serving as chair. Within this committee, discussions are held on the evaluation of executive directors, succession planning, and the executive remuneration framework, thereby ensuring transparency and soundness in management. To further accelerate decision-making, we introduced a delegated executive officer system in 2019, promoting greater delegation of authority.

In 2021, we transitioned our corporate governance structure from a company with a Board of Corporate Auditors to a company with an Audit and Supervisory Committee, thereby clarifying the separation between oversight and execution and advancing a monitoring-based governance model. In 2024, to further enhance corporate value and achieve sustainable growth under our medium-term management plan, we revised our executive remuneration system to strengthen incentive effects and better align interests with our shareholders.

Going forward, we recognize the need to respond to rapid environmental changes, expand our business portfolio that contributes to the advancement of digital technologies, and achieve a coexistence of economic and social value. To achieve this, we will continue to refine our strategic direction, enhance the governance framework to support swift and decisive decision-making, and evolve toward more effective and transparent corporate governance.

Directors and Board of Directors

Dexerials’ Board of Directors consists of eight members, including five outside directors, therefore outside directors always accounting for the majority.

In principle, the Board of Directors conducts regular meetings once per month, where it decides legally mandated matters, determines major management policies and strategies, selects candidates for officers, determines remuneration of individual directors, and oversees execution of business. The outside directors each have extensive experience and knowledge as managers or experts in their field and are able to play their role in strengthening supervisory functions from an independent perspective.

In addition, off-site meetings are held separately from the Board of Directors meetings to discuss the future of the Board of Directors and its policies from the formulation stage. They also inspect business sites, including those belonging to Group subsidiaries. We are also working to expand communication between outside directors and executive officers to ensure that discussions in Board meetings are based on a proper understanding of the situation of executive operations.

Audit and Supervisory Board

The Company’s Audit and Supervisory Committee comprises three members (of which two are outside directors) and is chaired by an outside director, which ensures the transparency and independence in audits. In addition, a position for one standing Audit and Supervisory Committee Member has been created to secure the effectiveness of audits.

Executive Officers and Board of Executive Officers

For business execution, executive officers delegate broad discretionary authority to eleven appointed executive officers, aiming to build a system that makes quick decision-making and clarifies executive responsibility.

Of the executive officers, two also serve as internal directors. The nine executive officers who do not serve as internal directors have concluded a delegation agreement with the Company regarding the execution of business.

In principle, the Board of Executive Officers is held twice a month, with eleven executive officers as members. It examines the status of, and issues regarding, business execution, in addition to conducting discussion of major proposals in advance in order to have meaningful dialogues at the Board of Directors meetings.

Click here for our list of officers

Nomination and Remuneration Committee

The Nomination and Remuneration Committee consists of five directors, of which more than a majority (three) are independent outside directors. In addition, the committee’s chairperson is an independent outside director to ensure objectivity and transparency.

The Nomination and Remuneration Committee discusses succession planning and training for officers, including the Representative Director and President, as well as the skills required to serve on the Board of Directors, from the perspective of our corporate vision.

In addition, the Committee has repeatedly discussed the appropriateness of remuneration structures and the performance-linked compensation system, as well as targets and evaluation, with regard to the basic policy for officer remuneration. Individual directors’ remuneration is determined through a formal process whereby the Nomination and Remuneration Committee conducts deliberations and submits its recommendations to the Board of Directors, which makes the final decision.

The Nomination and Remuneration Committee held seven meetings in FY2024. Discussions included the selection of officer candidates, confirmation of the training process for officer successors, skills required for the Board of Directors, evaluation of performance in determining remuneration for officers, the remuneration structure, and appropriate remuneration levels.

Nomination and Remuneration Committee Meetings in Fiscal 2024

| Date | Matters deliberated on |

|---|---|

| April 2024 |

|

| June 2024 |

|

| July 2024 |

|

| August 2024 |

|

| November 2024 |

|

| December 2024 |

|

| February 2025 |

|

* In addition to formal committee meetings, the company engaged in communication with domestic and international leaders.

Internal Audits and Audits by the Audit and Supervisory Committee

The Internal Audit Department strives to implement effective and efficient audits, establishes an internal control system for the Company and its Group companies, and audits the status of their implementation of, and compliance with, their respective compliance and risk management systems. In regards to the results of internal audits, the Internal Audit Department periodically reviews the status of enhancements, and reports those details to the Audit and Supervisory Committee, the representative directors, and any related departments.

Specifically, the section carries out internal audits based on the audit plan formulated at the beginning of the fiscal year, notifies the audited divisions of the results, while also informing the Audit and Supervisory Committee and the representative directors of the results. If there are any issues that require improvement, the section checks on the progress and results of their implementation.

The Department also regularly collaborates with the Standing Audit and Supervisory Committee Member to confirm the details of audits and exchange opinions.

Furthermore, the Department exchanges opinions with the Accounting Auditor every quarter, informing them on any material events concerning internal control that were found in internal audits and seeking their guidance and advice as needed.

Accounting Audits

The company has entered into an audit agreement with PwC Arata LLC, and that firm conducts accounting audits pursuant to the Companies Act and the Financial Instruments and Exchange Act.

PwC Arata and its managing partners who conduct audits of the Company have no special interests in the Company, and further, PwC Arata LLC has taken measures to prevent its managing partners from being involved in accounting audits of the Company exceeding a certain period.

Basic Policy and Procedures for Nomination of Candidates for Director

When nominating director candidates (excluding directors who are Audit and Supervisory Committee members) the Company selects candidates based on criteria such as decision-making capabilities and ability in accordance with the Company’s management philosophy, excellent character and communication skills, and leadership.

With regard to outside directors, the Company invites individuals who have experience as managers at global companies, knowledge relating to technology development, professional experience and expertise in areas such as law or financial accounting, and are highly independent.

When nominating candidates for director who are Audit and Supervisory Committee members, the Company selects candidates from inside and outside the Company based on the criteria of selecting one or more persons who possesses experience and knowledge in areas including corporate management, financial accounting, and law. In particular, the Company looks for candidates who have sufficient knowledge in finance and accounting.

Also, outside directors are determined in consideration of the balance of the knowledge, experience, specialist areas, etc., of the Board of Directors as a whole. This includes those with management experience at other companies, etc.

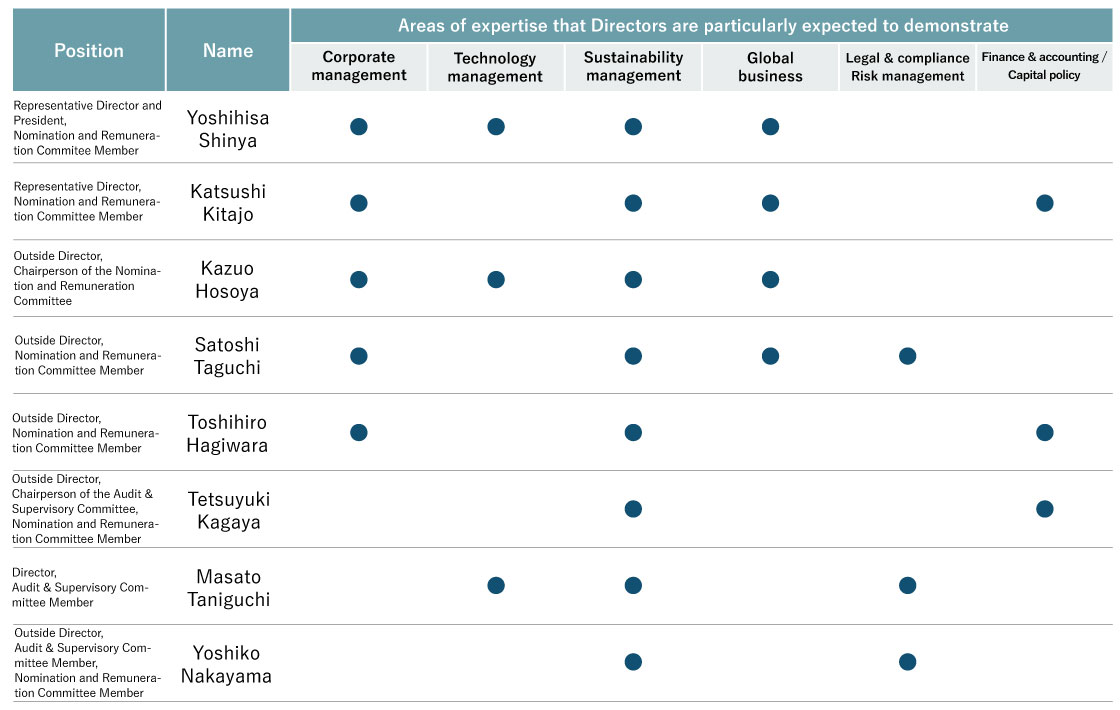

A skills matrix is used to present the areas of expertise that the Board of Directors should have and the balance between these areas.

Independent outside directors make up a majority of the Company’s Board of Directors, and accordingly, the mechanism is such that officer candidates are selected from a neutral perspective.

In addition, when appointing and dismissing management executives and nominating officer candidates, decisions are made based on the deliberations and reports of the Nomination and Remuneration Committee, a majority of the members and the chair of which are independent outside directors.

Skills Matrix of the Board of Directors

Reason for Selection as Director

| Position | Name | Management positions and major concurrent posts | Reason for selection |

|---|---|---|---|

| Representative director and president | Yoshihisa Shinya | President and Executive Officer | Mr. Yoshihisa Shinya has played a central role in product development with regard to the Company’s entry into new business fields and possesses deep insight into technology as well as extensive experience in business operations. The Company judges that he is capable of appropriately fulfilling his duties as Representative Director and therefore has appointed him to this position. |

| Representative director | Katsushi Kitajo | Senior Managing Executive Officer | Mr. Katsushi Kitajo has a wealth of experience and deep insight as a manager with his experience at a financial institution in corporate management as a Director and an Executive Officer and his involvement in investment and financing business, and in addition, with his experience as top management overseas and an Outside Director of another company. The Company judges that he is capable of appropriately fulfilling his duties as Representative Director and therefore has appointed him to this position. |

| Outside director | Kazuo Hosoya | Outside Director of JAPAN POST INSURANCE Co., Ltd., | Having served as the Representative Director and Chairman of a global company, Mr. Kazuo Hosoya has deep insight into corporate management. The Company judges that he can provide useful advice for the Company’s management from an objective and professional perspective and that he can contribute to strengthening the Company’s growth strategy and business development, and therefore has appointed him as an Outside Director. |

| Outside director | Satoshi Taguchi | Having held important posts at global companies, Mr. Satoshi Taguchi has deep insight into corporate management. The Company judges that he can provide useful advice for the Company’s management from an objective and professional perspective and that he can contribute to strengthening the Company’s risk management and supervision of business execution, and therefore has appointed him as an Outside Director. | |

| Outside director | Toshihiro Hagiwara | Having held important posts at a foreign investment fund, an M&A advisory firm, and technology-related human resource service companies, Mr. Toshihiro Hagiwara is well versed in each field of corporate acquisitions, finance, accounting, and tax affairs. He also has deep insight into corporate management with an awareness of capital markets and has abundant practical experience. The Company judges that he can provide useful advice for the Company’s growth strategy, capital policy, etc. from an objective and professional perspective and therefore has appointed him as an Outside Director. | |

| Outside director Audit and Supervisory Board Chair | Tetsuyuki Kagaya | Professor, Graduate School of Business Administration, Hitotsubashi University | Mr. Tetsuyuki Kagaya has deep insight into finance and accounting, evaluation of corporate value, risk analysis, etc. as a university professor. The Company judges that he can contribute to strengthening the audit and supervisory functions from an objective and professional perspective and provide useful advice for promoting ESG management, and therefore has appointed him as an Outside Director serving as Audit & Supervisory Committee Member. |

| Director and fulltime Audit and Supervisory Board Member | Masato Taniguchi | Mr. Masato Taniguchi has deep insight into the Company’s business, gained through his experience of serving as general manager of engineering and manufacturing units and in key positions at overseas manufacturing sites, and a proven ability to engage in smooth communication with frontline operations. He also has a wealth of experience and insight into audit practice through his service at the Company’s audit department and as an Audit & Supervisory Board Member of subsidiaries. The Company judges that he is capable of performing objective and appropriate audits from a professional perspective and therefore has appointed him as a Director serving as Audit & Supervisory Committee Member. | |

| Outside director Audit and Supervisory Board Member | Yoshiko Nakayama | General Manager, Legal Department, KLA Corporation | Ms. Yoshiko Nakayama has deep insight and practical experience in corporate legal affairs, mainly international legal affairs, as an attorney-at-law and as a person in charge of legal affairs at companies. The Company judges that she can contribute to strengthening the audit and supervisory functions from an objective and professional perspective and provide useful advice on compliance and corporate governance, and therefore has appointed her as an Outside Director serving as Audit & Supervisory Committee Member. |

Standards for Evaluating the Independence of Outside Directors

If it is determined that outside directors or candidates for outside director of the Company fulfil all of the following requirements, the Company shall deem said outside director or candidate for outside director to be independent from the Company:

- 1.The candidate has not held a position as director (excluding outside director. The same applies hereinafter), audit and supervisory board member (excluding outside audit and supervisory board member. The same applies hereinafter), executive officer, or agent (hereinafter “Director, etc.”) of the Company or any of its subsidiaries (hereinafter the “Dexerials Group”) either currently or in the ten years prior to being appointed.

- 2.The candidate is not related to a Director, etc. of the Dexerials Group within two degrees of consanguinity.

- 3.The candidate is not a major shareholder of the Company (or in the case of a major shareholder that is an organization such as a company, is not affiliated with said organization). (Note 1)

- 4.The candidate is not affiliated with an organization of that is a major shareholder of the Company. (Note 1)

- 5.The candidate is not a major trading partner of the Dexerials Group (or in the case of a major trading partner that is a company, etc. is not affiliated with said organization). (Note 2)

- 6.The candidate is not a major lender or other major creditor of the Dexerials Group (or in the case of a major lender that is an organization such as a company, is not affiliated with said organization). (Note 3)

- 7.The candidate has not received contributions of 10.00 million yen or more from the Dexerials Group in the current fiscal year (in the case the recipient of contributions is an organization such as a company or association, this applies to those who are affiliated with said organization or who have been affiliated with said organization in the previous five years).

- 8.The candidate has not received remuneration from the Dexeriels Group of 10.00 million yen or more as payment for the provision of specialist legal, financial, or taxation services, etc. or consulting, etc. in the current fiscal year (or in the case of a recipient that is an organization such as a company, is not affiliated with said organization).

- 9.The candidate is not subject to reciprocal appointment of outside officers between a company at which the candidate is a Director, etc. and the Dexerials Group. (Note 4)

- (Note 1) “Major shareholder” refers to a shareholder that directly or indirectly holds 10% or more of total voting rights.

- (Note 2) “Major trading partner” refers to companies for which payments made or payments received in transactions with the Dexeriels Group account for 2% or more of consolidated net sales of the Dexeriels Group or the trading partner.

- (Note 3) “Major lender” refers to a lender of a sum that amounts to 2% or more of consolidated total assets.

- (Note 4) “Reciprocal appointment of outside officers” refers to a scenario in which an outside officer is accepted from a company at which a Director, etc. of the Dexeriels Group serves as an outside officer.

Evaluation of the Effectiveness of the Board of Directors

Since FY2015, the Company has conducted annual evaluations of the effectiveness of the Board of Directors with the aim of achieving sustainable growth and enhancing medium- to long-term corporate value. The methodology and summary of the results of the evaluation conducted in FY2024 are as follows:

-

1.

Evaluation Methodology

To ensure objectivity and transparency, the evaluation is conducted by a third party who interviews each director individually based on a set of questions prepared by the Board Secretariat. The responses are analyzed and summarized to assess the effectiveness of the Board.

Based on these findings, the Board of Directors reviewed its activities for FY2024 and prepared an Action Plan for FY2025.

- 2.

Summary of Evaluation Results and Action Plan

(1)Summary

The third-party evaluation concluded that the overall effectiveness of the Board remains at a high level. Key strengths and improvements identified from directors’ responses include:

Execution of Board succession planning based on thorough deliberations by the Nomination and Remuneration Committee, which serves as an advisory body to the Board.

More focused and efficient Board operations, reflecting improvements made in response to past effectiveness evaluations.

For the Audit and Supervisory Committee, the following strengths and improvements were noted: Enhanced accuracy in information sharing by full-time committee members.

Improved effectiveness of departmental audits through stronger collaboration with the internal audit department.

(2)Action Plan for Enhancing Board Effectiveness in FY2025

“Enhancing the effectiveness of the Board of Directors by realizing management scenarios that contribute to sustainable growth and corporate value, while anticipating environmental changes and management risks.”

Key initiatives include:

① Discussion on the Board’s Functions and Roles to Enhance Medium- to Long-Term Corporate Value

Clarifying the ideal future state and the Board’s role in achieving the medium-term management plan.

Defining and prioritizing monitoring items and Board responsibilities.

② Review of the Audit and Supervisory Committee’s Role and Internal Audit Positioning

Reflecting on the four years since the transition to a company with an Audit and Supervisory Committee.

Strengthening governance to address long-term risks and enhance self-regulation on the executive side.

③ Clarification and Review of the Nomination and Remuneration Committee’s Structure and Advisory Scope

Revising the Committee’s composition and size based on current challenges.

Clarifying the distinction between “advice” and “recommendation.”

④ Clarification of the Expected Roles and Functions of Each Outside Director

Redefining the skills matrix and succession planning in alignment with the Company’s medium- to long-term vision and

strategy.

⑤ Improving Information Provision to Outside Directors to Enhance Discussion Quality

Enhancing access to decision-making information, early sharing of discussion points, and improving the timing and quality of

materials provided in advance

Officers’ Remuneration

Basic Approach

Our company determines its executive remuneration policy through resolutions of the Board of Directors, following thorough discussions within the Nomination and Remuneration Committee, which is chaired by an outside director and composed of a majority of outside directors. These discussions are conducted from an objective standpoint and focus on the ideal corporate governance structure going forward, as well as on the design of an executive remuneration system that contributes to sustainable growth and the enhancement of corporate value.

The appropriate remuneration levels are determined by comparing the Company’s current remuneration systems and levels with those of companies of similar size, type, and industry. This comparison is based on executive compensation survey data provided by external research organizations. Remuneration for directors (excluding outside directors) is determined by resolution of the Board of Directors, based on discussions held by the Nomination and Remuneration Committee. The amount is calculated in accordance with the company’s basic policy on executive remuneration, taking into account factors such as position, annual performance, and the degree of achievement of medium- to long-term targets. Remuneration for Audit and Supervisory Committee members is determined through consultation among the directors who serve on the Audit and Supervisory Committee.

Fundamental Approach to Determining Officer Remuneration

- Officers’ remuneration shall correspond to the role, responsibilities, and performance of each officer

- Officers’ remuneration shall be designed such that it reflects the medium- to long-term management strategy and also strongly incentivizes sustainable growth

- The composition of officer remuneration shall be such that it encourages the sharing of profits and risks with the shareholders, raises awareness of the shareholders’ perspective, and instills a stronger drive to enhance corporate value

- The level of remuneration shall be appropriate for attracting and retaining excellent global human resources

- The remuneration determination process shall be objective and transparent

Base Remuneration

Amounts are determined according to the job title in accordance with internal rules (weighted allocation according to job responsibilities), and a fixed monthly amount of remuneration is paid. Only base remuneration is provided to outside directors and directors serving as Audit and Supervisory Committee Members.

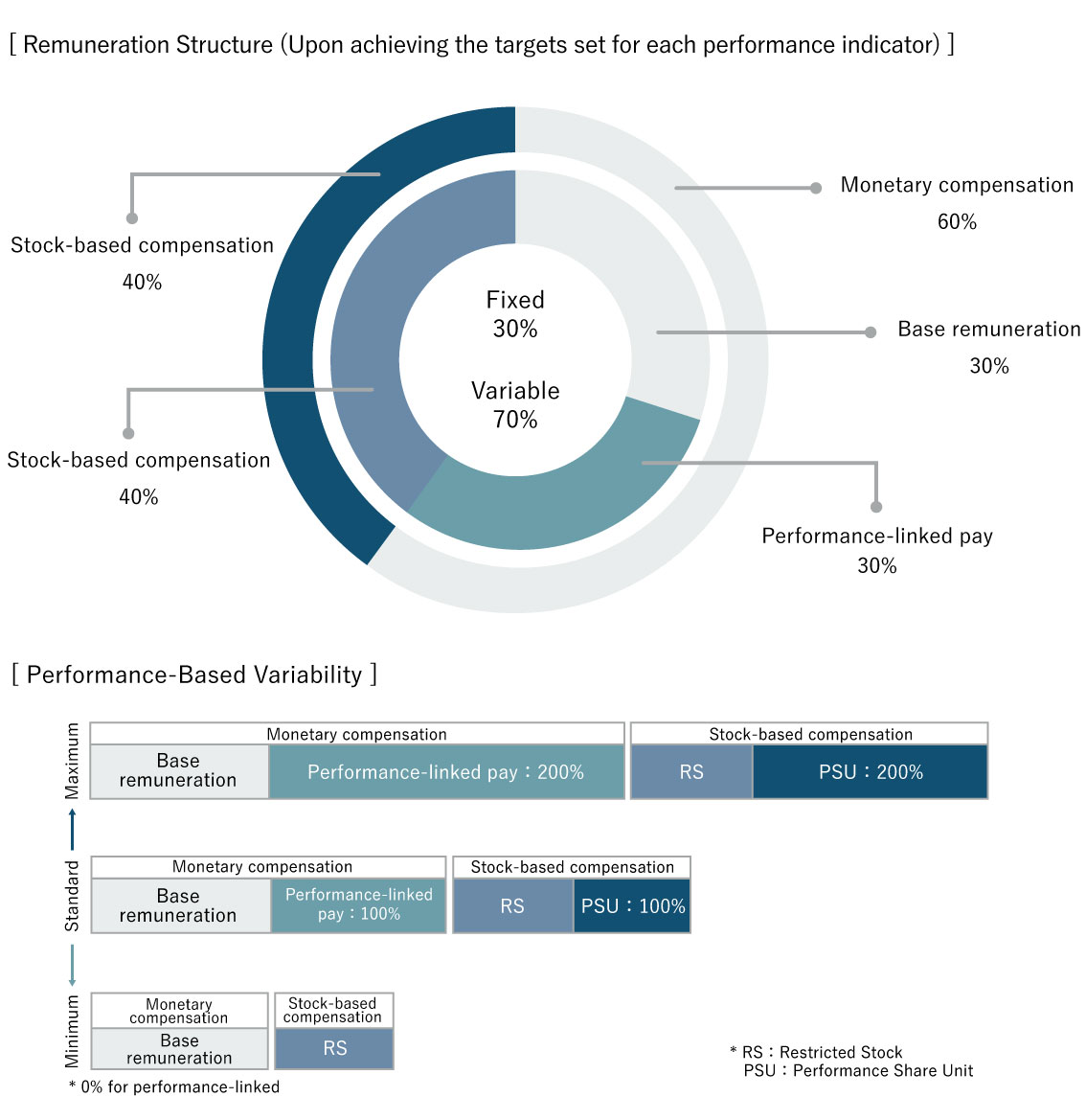

Performance-linked Compensation

Performance-linked compensation comprises “performancelinked pay,” which is paid according to performance during the fiscal year, and “stock-based compensation,” which is intended to foster the awareness that directors share interests with shareholders and to provide motivation for achieving objectives over the medium to long term. Performance-linked compensation is designed to motivate the Company’s executive directors to manage with an awareness of performance and share prices not just in a single fiscal year, but also over the medium to long term.

Performance-linked pay is determined using consolidated net sales and EBITDA, which demonstrate the Company’s earnings power, as evaluation indicators, while also taking into account the evaluation by the Remuneration Committee, which is chaired by an outside director and whose majority are outside directors. Regarding the above performance indicators, performance-linked pay is calculated at the ratio of 50% consolidated net sales and 50% EBITDA, and the amount determined is divided by 12 and the divided amount is paid monthly from the month following the conclusion of the Annual General Meeting of Shareholders.

Stock-based compensation is set separately from monetary compensation to strengthen the recipients’ awareness toward improving the Company’s medium- to long-term performance and enhancing corporate value. Specifically,once every five consecutive fiscal years, the Company contributes to a trust the capital necessary for acquiring the shares slated to be granted to the directors. The shares acquired through the trust are granted in two ways: restricted stock (RS) granted according to points commensurate to the job post, with one point being equivalent to one share, and performance share units (PSU) granted according to points reflecting the results versus the Mid-Term Management Plan, with one point also being equivalent to one share. Directors receiving the shares sign a transfer restriction agreement, which restricts them from disposing of the granted shares via transfer and other means until they retire as directors.

As evaluation indicators to determine PSUs, we use total shareholder return (TSR), which encourages directors to share profit-consciousness with the shareholders, in terms of both the benefit of stock price appreciation and the risk of stock price decline, while also motivating them to contribute to the Company’s sustainable growth and corporate value enhancement. On the front of technology and human capital (the materiality indispensable to our sustainable growth), the degree of our achievement of sustainability strategy targets set as priority management targets is reflected as well.

The amount of PSUs to be granted is determined based on the level of achievement of the above-mentioned indicators over the period of the Mid-Term Management Plan.

Furthermore, the amount of PSUs will be reduced partially or in full if we cannot reach the minimum targets that should be met to fulfill our responsibility as a corporate entity. These include cases where the average ROE performance during the performance-linked term falls short of a certain level or where the CO2 emissions reduction target is not achieved in the area of climate change, which is a material social issue.

Decision-making Process

In order to guarantee appropriate remuneration for officers and transparency of decision-making processes, the Company has established a Nomination and Remuneration Committee as an advisory body to the Board of Directors. The decision-making process of the Board of Directors shall involve referral to and deliberation by the Nomination and Remuneration Committee for matters relating to the composition of remuneration of directors (excluding directors who are Audit and Supervisory Committee members) and executive officers, determination of the appropriateness of design and setting targets for the performance-linked compensation system, and evaluation of performance, etc.

The remuneration of individual directors (excluding directors who are Audit and Supervisory Committee members) shall be determined by a resolution of the Board of Directors following discussion by the Nomination and Remuneration Committee and within the range of remuneration determined by a resolution of the General Meeting of Shareholders in advance.

The remuneration of individual directors who are Audit and Supervisory Committee members shall be determined through discussions among the Audit and Supervisory Committee members, within the range of the maximum remuneration amount approved in advance at the General Meeting of Shareholders.

Resolution at the Shareholders’ Meeting Regarding Directors’ Remuneration

At the shareholders’ meeting held on June 25, 2024, it was resolved that the maximum annual monetary remuneration for directors (excluding directors who are Audit and Supervisory Committee members) shall be no more than 450 million yen, of which 70 million yen is allocated for outside directors (hereinafter referred to as the “Monetary Remuneration Framework for Directors”). At the same meeting, it was also resolved—separately from the above monetary remuneration framework—that performance-linked stock-based remuneration shall be granted to directors (excluding directors who are Audit and Supervisory Committee members and outside directors). Under this scheme, points are granted based on position and performance indicators for each applicable period (every five fiscal years), with a maximum of 330,000 points. Following the stock split effective October 1, 2024, in which each common share was split into three shares, the maximum number of points granted per applicable period has been adjusted to 990,000 points. In principle, shares equivalent to one share per point are granted annually at a fixed time. If the conditions stipulated in the Executive Share-Based Remuneration Regulations are met, a certain portion of the points may be converted into cash equivalent to the market value of the shares at the time of retirement, instead of being granted as shares. Furthermore, the amount of remuneration received under this scheme is calculated by multiplying the total number of points granted to each applicable director (excluding Audit and Supervisory Committee members and outside directors) by the book value per share of the company’s stock held in the trust established for this remuneration system (hereinafter referred to as the “Stock-Based Remuneration Framework for Directors”).

As of the date of submission of the Annual Securities Report, five directors (including three outside directors) are eligible for remuneration under the Monetary Remuneration Framework for Directors, and two directors are eligible under the Stock-Based Remuneration Framework for Directors.

The maximum annual remuneration for Audit and Supervisory Committee members was also resolved at the same shareholders’ meeting to be no more than 70 million yen (hereinafter referred to as the “Remuneration Framework for Audit and Supervisory Committee Members”). As of the date of submission of the Annual Securities Report, three directors serving as Audit and Supervisory Committee members are eligible for remuneration under this framework.

Remuneration Structure and Performance-Based Variability for the Representative Director

Amount of Officers’ Remuneration in Fiscal 2024

| Officer classification | Total amount of remuneration, etc. (Yen in millions) |

Total amount of remuneration, etc. by type (Yen in millions) |

Number of eligible Base remuneration officers (Persons) | ||

|---|---|---|---|---|---|

| Base remuneration | Performance-linked compensation | ||||

| Performance-linked pay | Stock-based compensation | ||||

| Directors (excluding directors serving as Audit and Supervisory Committee Members) | 808 | 132 | 100 | 576 | 5 |

| Directors (Audit and Supervisory Committee Members) | 47 | 47 | - | - | 3 |

| Total | 856 | 180 | 100 | 576 | 8 |

| (of which outside officers) | 68 | 68 | - | - | 5 |